Stress Test: Gauging Indian states' fiscal stability and challenges

30-12-2024 12:00:00 AM

Assessing fiscal health of states amid debt burdens, mounting expenses, and transparency challenges for reforms.

Prudent fiscal management is vital for promoting long-term economic growth and ensuring public goods. Much like a family thrives when daily expenditure stays below income, governments must allocate resources wisely to meet present needs and secure future growth.

India’s federal system, comprising Union and State governments with distinct roles, functions as a single fiscal entity. Recognizing this interdependence, the Constitution incorporates safeguards to prevent fiscal collapse.

Articles 293 and 360 empower the Union to impose borrowing conditions or declare financial emergencies in states. However, these measures are politically fraught, underscoring the importance of proactive fiscal discipline.

In recent years, while the Union government has demonstrated impressive fiscal restraint, states show a mixed record. Objective and transparent evaluation of state finances is critical to avoid perceptions of political bias and enable timely intervention. Kerala’s Supreme Court plea for greater borrowing freedom illustrates the need for impartial fiscal health assessments.

A model akin to the Reserve Bank of India’s stress tests for banks could help identify vulnerabilities and ensure stability.

Key Indicators of Fiscal Health

1. Debt-to-GSDP Ratio

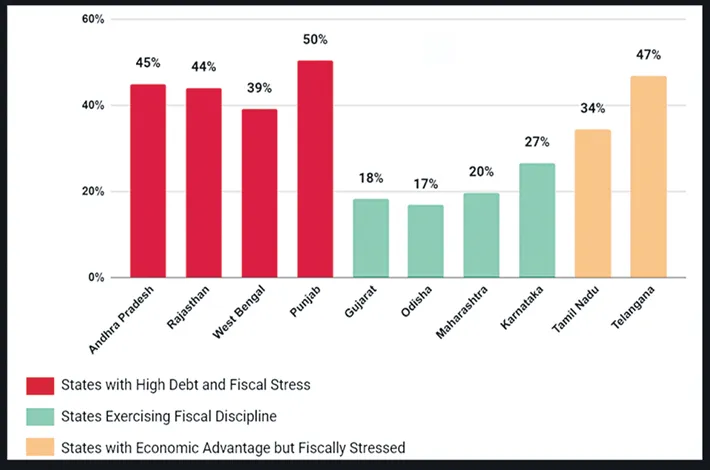

The ideal benchmark for states is around 20%. States like Gujarat, Odisha, Maharashtra, and Karnataka maintain debt levels between 17% and 27% of their Gross State Domestic Product (GSDP). Conversely, Andhra Pradesh, Rajasthan, West Bengal, and Punjab exceed 39%, with figures reaching 50%. High debt levels lead to escalating interest payments, risking a debt trap.

2. Committed Expenditure

Fixed obligations such as salaries, pensions, and interest payments can consume a disproportionate share of state revenues. Healthier states, such as Gujarat and Karnataka, allocate 62%–79% of their own revenues to such expenses. Meanwhile, stressed states like Andhra Pradesh and Punjab exceed 100%, dipping into Union transfers even for non-discretionary expenditures.

3. Interest Burden

A significant share of revenue directed toward interest payments indicates fiscal strain. Tamil Nadu and Telangana occupy a middle ground. While they benefit from strong economies, vibrant metropolises, and high per capita incomes, their fiscal management requires improvement to reduce debt-to-GSDP and committed expenditure ratios.

Challenges in Transparency

Accurate data is critical for fair fiscal assessments. However, states often obscure liabilities through off-budget loans, channeling debt to Special Purpose Vehicles that lack independent revenue streams. Deferred bill payments further conceal true liabilities. Such practices exploit the cash accounting system, delaying scrutiny.Transparent accounting is essential for accurately assessing fiscal health.

Way Forward

Regular stress tests based on transparent criteria can help states address vulnerabilities, delink finances from partisan politics, and safeguard India’s economic future. Strengthened fiscal discipline and accurate reporting will enhance the ability to implement timely corrective measures and promote economic stability across the nation.