Sensex reclaims 80K-level

24-04-2025 12:00:00 AM

Mkts | Trump softens China tariffs , says no plan to sack Fed boss

Comments and actions of Mr Trump as the leader of the world's largest economy, will continue to influence markets and investor-sentiment, say experts

FPJ News Service MUMBAI

Indian markets extended the winning run to the seventh day on Wednesday and sustained their positive momentum. “It appears that President Trump has softened his approach to China and the Fed chief. He said he has “no intention of firing” Powell after repeatedly criticising the head of the US central bank as “Mr Too Late”, but he added that he would like Powell to be “a little more active” on cutting interest rates.

The Indian economy is fundamentally strong. However, comments and actions of Mr Trump as the leader of the world's largest economy, will continue to influence markets and investor-sentiment,” said a veteran stockbroker. The BSE Sensex climbed 521 points to close above 80,000 level for the first time in four months driven by strong gains in technology and auto shares.

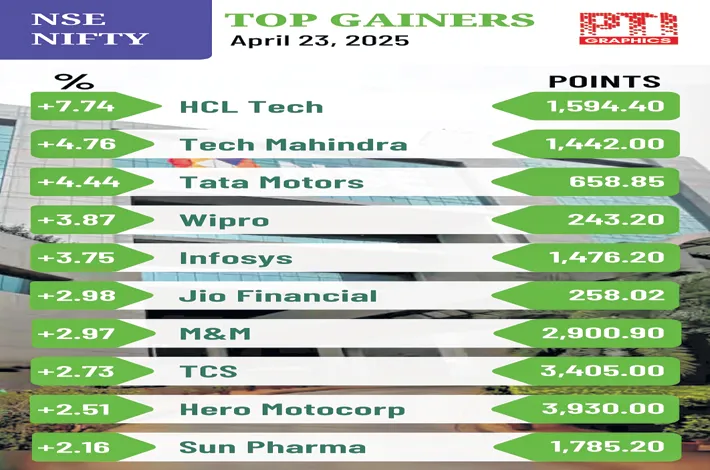

The 30-share Sensex rose by 521 points to settle at 80,116.49, the highest closing level since December 18. The NSE Nifty rallied 161.70 points to 24,328.95. HCL Tech surged the most by 7.7% after the firm posted an 8.1% jump in consolidated net profit at Rs 4,307 crore for March quarter 2024-25, mainly on account of large deals with a total contract value of about Rs 25,500 crore.

“The Indian equity market sustained its positive momentum, driven by better Q4 earnings from IT companies and a relatively optimistic international scenario. However, profit-booking was visible in financials after the recent sharp rally. While US-China trade tensions appear to be easing, a rally in US tech stocks has further bolstered overall global market sentiment. The mixed domestic Q4 earnings and uptick in crude prices, along with the recent outperformance of the domestic market, can trigger some consolidation in the near term,” said Vinod Nair, Head of Research at Geojit Investments.

“Terror attacks while succeeding in taking precious human lives cannot succeed in even marginally impacting our economy and markets. Pakistan’s political instability and basket case economy cannot do any damage to the Indian economy and markets. This message and macro fundamental factors are favourable. Trump’s message that he has no intention of firing the Fed chief has calmed the US markets.

Trump’s remarks on Chinese tariffs indicate that he might reduce the US-China tensions. The sustained buying by FIIs is a strong support to domestic markets. Technically, the market might move into an overbought territory soon inviting some profit booking. Investors should remain invested in high quality largecaps,” said Dr VK Vijayakumar, Chief Investment Strategist, Geojit Investments.

Tech Mahindra, Tata Motors, Infosys, Mahindra & Mahindra, Tata Consultancy Services, Tata Steel, Bharti Airtel and Maruti were among top gainers. Banking shares witnessed a sell-off after recent sharp gains with HDFC Bank dropping by 1.98% as the biggest loser among Sensex shares.