Mkts cautious as Indo-Pak tensions dampen sentiment

26-04-2025 12:00:00 AM

FPJ News Service mumbai

Investor sentiment turned cautious on Friday amid escalating Indo-Pak tensions.

The current situation, according to a veteran economist, is “tailwinds on one side, and headwinds on the other”. The world has witnessed nuclear-armed neighbours India and Pakistan fighting two wars, and conflicts over Kashmir, and another major war will be a disaster in all sense. Escalating tensions will have a negative impact on Indian stock markets.

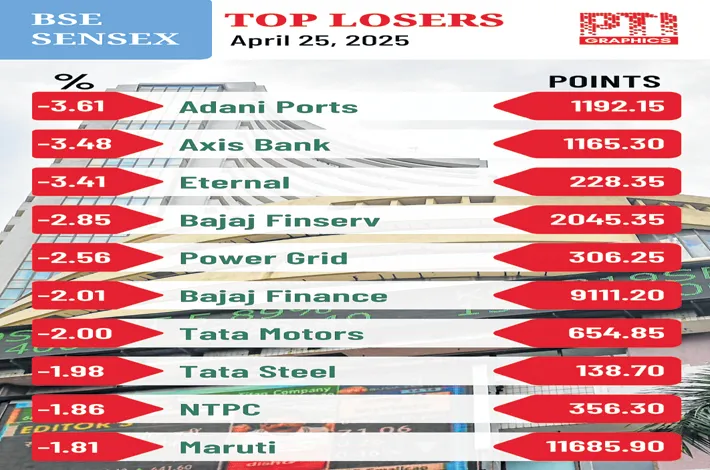

Wiping out all early gains, the BSE 30-scrip Sensex tanked 588.90 points to settle at 79,212.53. Falling for the second day, the NSE Nifty tumbled 207.35 points to 24,039.35. Investors’ wealth got wiped out by Rs 8.88 lakh crore in two days of market slump due to profit-taking and growing tensions following the terror attack at Pahalgam in Jammu & Kashmir. The market capitalisation of BSE-listed companies declined by Rs 8.88 lakh crore to nearly $4.93 trillion in two days.

Tensions between the two countries further escalated on Friday, as the Pakistani side reconfirmed that it would consider India’s response as “an act of war” if India followed through on a threat to block the flow of crucial rivers as punishment for a deadly militant attack in Kashmir. PM Modi had vowed to pursue “to the ends of the earth” those behind a militant attack that killed 26 people in India-administered Kashmir. “I say to the whole world: India will identify, track and punish every terrorist and their backers,” Modi had said during a rally in Bihar.

“A strong tailwind for Indian markets is the sustained FII buying which has touched a cumulative amount of Rs 29,513 crore during the last 7 days till Thursday. FIIs bought equities worth Rs 2,952.33 crore on Friday. This is a total reversal of the momentum trade to US stocks. Since FII buying is likely to sustain, bears will restrain from shorting the market.

“Another tailwind is US Treasury Secretary Bessent’s remark that “India is expected to strike the “first” bilateral trade deal with the US. The US is also keen to strike as many deals as possible since China’s response to US initiatives has been indifferent. The resilience of the India economy can continue to support domestic markets. The potential headwind looming large on the horizon is the uncertainty regarding India’s response to the terror attack and its consequences,” said Dr VK Vijayakumar, Chief Investment Strategist, Geojit Investments.

“Mid- and small-cap stocks bore the brunt of the sell-off, driven by their elevated valuations and growing concerns over potential earnings downgrades following a muted start to the earnings season. The risk of the correction continuing in the near term is evident as investors adopt a wait-and-watch stance. However, it is a good time for persistent investors to dip into it, given the resilient nature of the Indian stock market during external & geopolitical volatility,” said Vinod Nair, Head of Research, Geojit Investments.