Markets maintain resilience on renewed hopes of macro fundamentals, Q4 earnings

28-03-2025 12:00:00 AM

FPJ News Service mumbai

The broader market demonstrated resilience on Thursday supported by expectations of double-digit earnings growth in FY26, easing of inflation, a downward trend in interest rates, and improved domestic macro fundamentals.

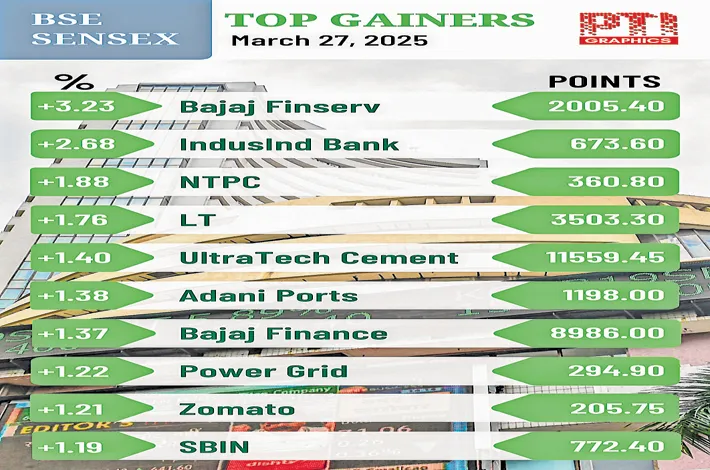

Market men anticipate that the RBI may cut interest rates at a second straight meeting on April 9, and one more cut in August cannot be ruled out. Despite President Trump imposing tariffs on steel and auto imports to the US, easing of inflation, expectations of reasonable growth in Q4 earnings of large corporate entities, and a potential mutually beneficial US trade deal are seen strengthening the market sentiment. FIIs inflows and buying in L&T, Reliance Industries, and Bajaj Finance supported to maintain the uptrend on Thursday.

The 30-share BSE Sensex climbed 317.93 points to close at 77,606.43. The NSE Nifty gained 105.10 points at 23,591.95. “Key indices maintained optimism throughout the day, driven by sustained foreign fund inflows and the purchase of blue-chip stocks. However, the 25% tariff on auto imports imposed by US President Trump has affected auto stocks and raised concerns.

Despite these challenges, the broader market demonstrated resilience, supported by expectations of improved domestic fundamentals. “Attention is now focused on the US-India trade meeting, which commenced on Wednesday, aiming to provide greater clarity on the bilateral trade agreement between the two nations,” Vinod Nair, Head of Research at Geojit Investments told The Free Press Journal.

“The market has turned cautious as the reciprocal tariff day approaches. Institutional activity suggests that while FIIs are not overly concerned about tariffs DIIs are taking a cautious stance. Despite net institutional buying remaining good, the market drifted down indicating concern and fear,” said Dr. VK Vijayakumar, Chief Investment Strategist, Geojit Investments.