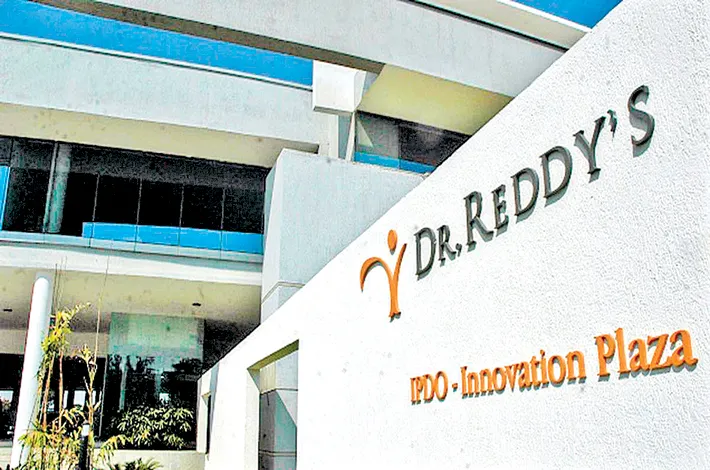

Dr. Reddy’s Laboratories slashes workforce costs by 25%, signals major restructuring

15-04-2025 12:00:00 AM

The internal directive is clear: reduce manpower costs by about a quarter,” one source told. Several senior employees have already been approached to tender their resignations, and the process is being handled discreetly to minimize disruption.”

Metro India News | Hyderabad

Dr. Reddy’s Laboratories, one of India’s leading pharmaceutical companies, has embarked on a significant cost-cutting initiative, aiming to reduce its workforce-related expenses by 25%, according to multiple news reports. The move, which includes asking several high-earning executives in the Rs 1-crore-plus salary bracket to resign, is part of a broader restructuring effort to bolster financial efficiency amid challenging market dynamics. The Hyderabad-based pharma giant is also contemplating a complete shutdown of its digital therapeutics division and downsizing its nutraceuticals arm, potentially impacting 300 to 400 employees across the organization.

The announcement comes at a time when the global pharmaceutical industry is grappling with economic uncertainties, pricing pressures, and shifting demand patterns. Dr. Reddy’s, known for its robust portfolio in generics, active pharmaceutical ingredients (APIs), and branded formulations, has been navigating a complex landscape marked by declining revenues from key drugs and increased operational costs.

The company’s latest financials for the third quarter of FY25 (October–December 2024) reported a modest 2% year-on-year increase in consolidated profit after tax at Rs 1,413.3 crore, with revenues rising 16% to Rs 8,358.6 crore. However, employee benefits expenses rose 7% to Rs 1,367 crore, underscoring the need for cost optimization.

Sources familiar with the development indicate that the workforce reduction targets high-salaried professionals across various departments, particularly those earning over Rs 1 crore annually. These include senior executives in leadership and mid-senior roles, many of whom have been integral to the company’s growth over the years. “The internal directive is clear: reduce manpower costs by about a quarter,” one source told a leading business daily. “Several senior employees have already been approached to tender their resignations, and the process is being handled discreetly to minimize disruption.”

In addition to executive exits, Dr. Reddy’s has offered voluntary retirement schemes to employees aged 50–55 in its research and development (R&D) division. This move is seen as a strategic effort to streamline operations in a segment that has faced scrutiny for high costs relative to output. The company’s R&D efforts, while critical for innovation, have been under pressure to deliver commercially viable products in a competitive market. The voluntary retirement scheme aims to reduce headcount without resorting to mass layoffs, offering a softer landing for long-serving employees.

The most significant structural change, however, involves the potential closure of the digital therapeutics division. Launched as part of Dr. Reddy’s foray into innovative healthcare solutions, the division has struggled to meet performance expectations. Digital therapeutics, which involve software-based interventions for managing diseases, have yet to gain widespread traction in India and globally, leading analysts to question their viability within the company’s portfolio. “If the division isn’t delivering projected returns, it makes sense to reallocate resources elsewhere,” noted an industry analyst. The shutdown could affect a significant portion of the estimated 300–400 job cuts.

The nutraceuticals arm, another relatively new venture for Dr. Reddy’s, is also facing downsizing. The company entered the nutraceuticals market through a joint venture with Nestlé in 2024, aiming to capitalize on growing consumer demand for health supplements. However, sources suggest that the unit has underperformed, prompting a reevaluation of its scale. While not facing a complete shutdown, the nutraceuticals division may see reduced staffing and a narrower focus to improve profitability.

The cost-cutting measures are expected to yield substantial savings, with estimates suggesting an annual reduction of approximately Rs 1,300 crore in workforce expenses. In FY23-24, Dr. Reddy’s reported total employee benefits expenses of Rs 5,030 crore, alongside hiring 6,281 new employees and investing Rs 39.2 crore in training and development. The median employee remuneration also rose by 7% during the year, reflecting the company’s commitment to its workforce. However, the current restructuring signals a shift toward leaner operations, driven by the need to maintain double-digit growth and achieve 25% EBITDA margins, as outlined by company leadership.

The layoffs and divisional changes have sparked concerns among employees and industry observers. Social media platforms like X have been abuzz with reactions, with some users expressing sympathy for affected workers and others debating the broader implications for India’s pharma sector. “Every sector is going through turmoil – last six months, things have gone from bad to worse,” wrote one user, highlighting the pervasive economic challenges. Another post noted that the decline in revenues from Revlimid, a key cancer drug facing patent expiry in 2026, may have accelerated Dr. Reddy’s cost-cutting drive.

Analysts remain cautiously optimistic about the company’s long-term prospects. Despite a nearly 19% drop in share price year-to-date in 2025, closing at Rs 1,110 per share on April 11, Dr. Reddy’s continues to pursue growth through strategic partnerships and biosimilar development. Recent collaborations with Alvotech and Bio-Thera Solutions for biosimilars targeting bone diseases and other conditions signal a focus on high-potential areas. However, the success of these initiatives will depend on the company’s ability to navigate regulatory hurdles and market competition.

Dr. Reddy’s has not issued an official statement confirming the layoffs or divisional changes, and efforts to verify the reports independently are ongoing. The company’s leadership, led by Co-Chairman and Managing Director G.V. Prasad, has previously emphasized operational efficiency and innovation as core priorities. In a recent earnings call, Prasad highlighted progress in building a robust product pipeline, but acknowledged near-term headwinds affecting profitability.

As Dr. Reddy’s moves forward with its restructuring, the pharmaceutical industry will be closely watching. The company’s ability to balance cost reduction with innovation could set a precedent for others in the sector facing similar pressures. For now, the focus remains on executing a delicate transition, ensuring that the pursuit of financial health does not come at the expense of its legacy as a trusted name in global healthcare. However, there is no official communication from Dr Reddy’s on this.